This is still a barometer of Investment Madness in WEB 2.0 bubble to watch. Untill this stock corrects to its "more reasonable level" of 30-40 FCF we will be still in a bubble state. Unhealthy expectations of next 20% upside with potential 50% downside are driven by liquidity, but it is quickly drying out...

The last time Warren Buffet sad in China: Google is great company and its easy to see it, but valuation is different: at 200 billion MC (it was before recent run) just to deliver 14% p.a. return to shareholders it needs to reach valuation of 400 billion in five years.

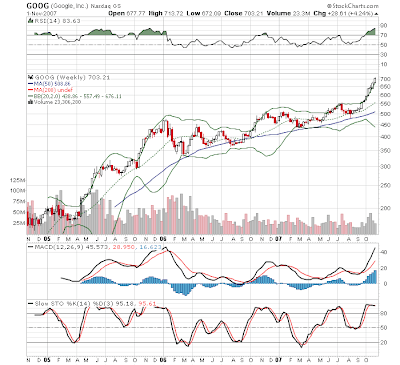

I have run the numbers again with GOOG at 694USD its market cap was 217 bil. Now MC/FCF=74.8! CAPEX has decreased from 597 to 553 mil in 2007 Q3 from Q1. Assuming at least the same CAPEX (hitting competition, Video - new storage blades ets.) FCF margin is 25.6%. In order to reach "normal valuation to MC/FCF=30") with return of 15% p.a. in five years time FCF must be 14.6 bil! and Revenue 57 bil! It means 30% growth year over year without any CAPEX growth extension. Google will reach MC of 437 bil in this case. Is it possible with economy marching into recession? I do not think so, but even if you are optimist here it is 15% per year with all risks of downside of one trick pony business and hitting competition. To give the idea of "normal MC/FCF valuation" Royal Gold RGLD will need to double overnight just to get there.

No comments:

Post a Comment