With all recent excitement about Lithium and REE TNR Gold's old solid Copper play is almost forgotten. CEO of TNR Gold Mr Gary Schellenberg reminded us in a recent interview that all impressive recent stock run is a mere reflection of a value of the few assets held by TNR. He considers Los Azules in production in a few years as a "mile stone" - we consider it as a very nice bonus to all the story and Mr Market so far is not considering it as a value at all.

With all recent excitement about Lithium and REE TNR Gold's old solid Copper play is almost forgotten. CEO of TNR Gold Mr Gary Schellenberg reminded us in a recent interview that all impressive recent stock run is a mere reflection of a value of the few assets held by TNR. He considers Los Azules in production in a few years as a "mile stone" - we consider it as a very nice bonus to all the story and Mr Market so far is not considering it as a value at all. We will put just a few bullet points for his consideration:

1. NPV of Los Azules is 500 mil USD at a Long term Copper price at 1.9 USD/lb, it rises to 1 bil USD with long term Copper price at 2.1 USD/lb.

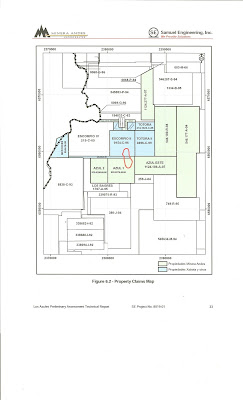

2. TNR Gold has 25% back in right to Northern part of the deposit with high grade core and extension of mineralisation under legal dispute with Xstara now.

3. Recent move of Barrick Gold ABX into Pascua Lama with 3 bil USD investment in the same San Juan province in Argentina.

4. Escorpio IV from maps in Minera Andes's technical report looks like is in the place of mining facilities planed for project development.

5. Mr Gold Corp Rob McEwen effectevely has taken over Minera Andes MAI.v after corporate fight and 40 mil CAD investment at 1.0 CAD still above the market price as of today.

6. Last winter Xstrata or Minera Andes could still think about "easy solution" of the law suit by taking over TNR Gold at a fraction of its assets value, now with revealed group behind the TNR Gold these guys does not look like in need for a lunch money and has been accumulating stakes before recent Lithium drive. Are they in for a Los Azules play initially? Can we have a treat of M&A action here? You can hardly finance such an enterprise with claims about part of the deposit and adjacent property, where your engineers are planing for mining facilities. After recent corporate actions Sir Rob McEwen reconfirmed his reputation and played fair and square with open hands. Will he act as a mediator in this case and we can expect a mutual deal? In any case critical mass of all these interests involved and rising Copper price will keep this situation spinning to its conclusion.

7. Legal action was started by the Junior against Xstrata, now we have a hint that it was a strategic decision and financing is in place for a legal fight - according to filing TNR Gold is represented by George K. Macintosh, Q.C. from Farris in Vancouver:

"George Macintosh leads the litigation group in the law firm of Farris in Vancouver, British Columbia, where he has practised since his call to the Bar of British Columbia. He was appointed Queen’s Counsel in British Columbia in 1987, elected as a Fellow of the American College of Trial Lawyers in 1991 and a Fellow of the International Society of Barristers in 2001. Canadian, U.S. and U.K. publications repeatedly rank him as one of Canada’s leading commercial litigators." Such a gentleman will not play peanuts in something without merit, but we will not speculate here. Is it all too much for one Junior or somebody has carefully calculated the value of the prise?

5. Mr Gold Corp Rob McEwen effectevely has taken over Minera Andes MAI.v after corporate fight and 40 mil CAD investment at 1.0 CAD still above the market price as of today.

6. Last winter Xstrata or Minera Andes could still think about "easy solution" of the law suit by taking over TNR Gold at a fraction of its assets value, now with revealed group behind the TNR Gold these guys does not look like in need for a lunch money and has been accumulating stakes before recent Lithium drive. Are they in for a Los Azules play initially? Can we have a treat of M&A action here? You can hardly finance such an enterprise with claims about part of the deposit and adjacent property, where your engineers are planing for mining facilities. After recent corporate actions Sir Rob McEwen reconfirmed his reputation and played fair and square with open hands. Will he act as a mediator in this case and we can expect a mutual deal? In any case critical mass of all these interests involved and rising Copper price will keep this situation spinning to its conclusion.

7. Legal action was started by the Junior against Xstrata, now we have a hint that it was a strategic decision and financing is in place for a legal fight - according to filing TNR Gold is represented by George K. Macintosh, Q.C. from Farris in Vancouver:

"George Macintosh leads the litigation group in the law firm of Farris in Vancouver, British Columbia, where he has practised since his call to the Bar of British Columbia. He was appointed Queen’s Counsel in British Columbia in 1987, elected as a Fellow of the American College of Trial Lawyers in 1991 and a Fellow of the International Society of Barristers in 2001. Canadian, U.S. and U.K. publications repeatedly rank him as one of Canada’s leading commercial litigators." Such a gentleman will not play peanuts in something without merit, but we will not speculate here. Is it all too much for one Junior or somebody has carefully calculated the value of the prise?

"Vancouver B.C.: TNR Gold Corp. ("TNR" or the "Company") advises that, on August 8, 2008, it amended its writ of summons in the action commenced on June 30, 2008 in the Supreme Court of British Columbia against MIM Argentina Exploraciones S.A. ("MIM") a subsidiary of Xstrata PLC. ("Xstrata"). In the amended action TNR is adding: "Further, the Exploration and Option Agreement, to the extent that it purports to terminate Solitario's (TNR's Argentina subsidiary) right to buy back equity in mining and exploration tenures acquired by MIM pursuant to the Exploration and Option Agreement if MIM fails to complete a feasibility study on any part of the properties within 36 months of exercising its option does not reflect the true agreement and common intention of the parties and was the result of a mutual mistake of the parties. The true agreement of the parties was reflected in the Letter of Understanding which provided that Solitario's back-in right subsists until 120 days after completion by MIM of a feasibility study on any part of the acquired properties. The plaintiffs therefore seek rectification of the Exploration and Option Agreement to accord with the true intentions of the parties.Further, or in the alternative, the 36 month provision in the Exploration and Option Agreement was inserted by MIM without consideration and is unenforceable.Further, or in the alternative, Solitario says that MIM is in breach of the Exploration and Option Agreement by entering into an agreement or agreement with a third party to undertake exploration work on the acquired properties without requiring the third party to complete a feasibility study on any of the properties within any time frame."

"Vancouver B.C.: TNR Gold Corp. ("TNR" or the "Company") advises that, on August 8, 2008, it amended its writ of summons in the action commenced on June 30, 2008 in the Supreme Court of British Columbia against MIM Argentina Exploraciones S.A. ("MIM") a subsidiary of Xstrata PLC. ("Xstrata"). In the amended action TNR is adding: "Further, the Exploration and Option Agreement, to the extent that it purports to terminate Solitario's (TNR's Argentina subsidiary) right to buy back equity in mining and exploration tenures acquired by MIM pursuant to the Exploration and Option Agreement if MIM fails to complete a feasibility study on any part of the properties within 36 months of exercising its option does not reflect the true agreement and common intention of the parties and was the result of a mutual mistake of the parties. The true agreement of the parties was reflected in the Letter of Understanding which provided that Solitario's back-in right subsists until 120 days after completion by MIM of a feasibility study on any part of the acquired properties. The plaintiffs therefore seek rectification of the Exploration and Option Agreement to accord with the true intentions of the parties.Further, or in the alternative, the 36 month provision in the Exploration and Option Agreement was inserted by MIM without consideration and is unenforceable.Further, or in the alternative, Solitario says that MIM is in breach of the Exploration and Option Agreement by entering into an agreement or agreement with a third party to undertake exploration work on the acquired properties without requiring the third party to complete a feasibility study on any of the properties within any time frame.""Los Azules -- Defined 43-101 resource

On February 5th, 2009, Minera Andes (MAI) announced a preliminary assessment for the Los Azules deposit, of which highlights include a NPV of $496 million, capital payback in 6.4 years, production cost of $0.85 copper, and a 23.6 year mine life. On September 25, 2008, MAI announced high percentile metallurgical testing results at Los Azules, recovering up to 96% copper. On September 8, 2008, MAI announced an inferred mineral resource estimate of 922 million tonnes of 0.55% copper at Los Azules, resulting in approximately 11.2 billion pounds of copper. Please note mineral resources that are not mineral reserves do not have demonstrated economic viability.TNR retains a conditional 25% back-in option on Xstrata's portion of the Los Azules deposit that MAI optioned from Xstrata. TNR commenced action in the Supreme Court of British Columbia on June 30, 2008 and subsequently amended its action on August 8, 2008, against MIM Argentina Exploraciones S.A., a subsidiary of Xstrata PLC. TNR is seeking rectification of the Exploration and Option agreement to accord with the true intentions of the parties and to remove the 36 month time provision on TNRs back-in right. TNR is also seeking confirmation of ownership, without claim from Xstrata, of the strategically located Escorpio IV claim."

"Minera Andes announces delivery of earn-in notice under option agreement at Los Azules Copper Project

On Wednesday June 3, 2009, 1:00 pm EDT

<<>>SPOKANE, WA, June 3 /CNW/ - Minera Andes Inc. (the "Corporation" or "Minera Andes") (TSX: MAI and US OTC: MNEAF) is pleased to announce the earn-in notice has been delivered to exercise its option to acquire a 100 percent interest in the Los Azules Copper Project (the "Project") located in the San Juan Province of western central Argentina, subject to the right of Xstrata Copper to back-in to the Project for a 51% interest. The notice was delivered pursuant to the Los Azules Option Agreement between Minera Andes and certain of its subsidiaries and Xstrata Copper, one of the commodity business units within Xstrata plc (London Stock Exchange: XTA.L and Zurich Stock Exchange: XTRZn.S), and its subsidiary, on the Project.By Minera Andes exercising its earn-in option on May 29, 2009, Xstrata Copper has 90 days to notify Minera Andes whether it intends to exercise its right to back-in to the Project for a 51% interest (the "Back-in Right") under the Los Azules Option Agreement. After delivery of such back-in notice, in order to complete the Back-in Right, Xstrata Copper must pay to a subsidiary of Minera Andes within 90 days after delivery of such notice 300% of the direct expenditures incurred by Minera Andes and its affiliates on the Project area since November 25, 2005, and assume operational control and responsibility of the Project within 120 days of such notice. Xstrata Copper will also be required to produce a bankable feasibility study in conformity with the standards set out in National Instrument 43-101 - Standards of Disclosure for Mineral Projects, adopted by the Canadian Securities Administrators ("NI 43-101") within 5 years of such notice.The Project area contains a copper deposit situated on adjoining properties that straddle a large copper porphyry system, which was the subject of a recent NI 43-101 technical report and scoping study containing an inferred mineral resource estimate of 922 million tonnes of 0.55 % copper. The deposit as currently defined is open in several directions, and further drilling will be required to fully define the limits of the mineralization, especially along the strike to the north and at depth where many of the drill holes have bottomed in copper mineralization.Los Azules Option Agreement DetailsThe Project is an exploration project comprised of properties owned by Andes Corporacion Minera S.A. ("Andes"), an indirect wholly-owned subsidiary of Minera Andes (the "Andes Properties") and adjoining properties held by MIM Argentina Exploraciones S.A. for Xstrata Copper ("MIM" and the "MIM Properties"). The Project is subject to the Los Azules Option Agreement dated November 2, 2007, as amended. Under the Los Azules Option Agreement, Los Azules Mining Inc. ("LAMI"), a indirect subsidiary of Minera Andes, has earned a 100% interest in the MIM Properties and MIM is now required under the terms of the Los Azules Option Agreement, to transfer the MIM Properties to Andes which Andes will hold together with the Andes Properties (the "Combined Property").

Certain of the MIM Properties are subject to an underlying option agreement, which is the subject of a dispute between Xstrata Copper, as option holder, and Solitario Argentina S.A. ("Solitario"), as the grantor of that option and the holder of a back-in right of up to 25%, exercisable upon the satisfaction of certain conditions, within 36 months after the exercise of the option by Xstrata Copper. The dispute surrounds the validity of a 36 month restriction on a back-in-right held by Solitario.

About Minera AndesMinera Andes is a gold, silver and copper exploration company working in Argentina. The Company holds about 304,000 acres of mineral exploration land in Argentina. The producing San José silver/gold mine is 49% owned by Minera Andes through a joint venture. Minera Andes is also exploring the Los Azules copper project in San Juan province, where an exploration program has defined a resource and a scoping study has been completed. Other exploration properties, primarily silver and gold, are being evaluated in southern Argentina. The Corporation presently has 230,538,851 shares issued and outstanding.This news is submitted by Allen V. Ambrose, President and Director of Minera Andes Inc."

No comments:

Post a Comment