"I am a big believer in the company where management owns a big part of the company: if I am making money - you are making money, I am making money only from capital gains." Robert McEwen.

"One thing is to find and develop a Copper deposit with NPV over 1 billion with Copper over 2.1 USD/lb and another one is to find a good lawyer, who made his name going against big corporations, and defend your rights in court. If Junior TNR Gold TNR.v one year ago decided to bully a multi billion market cap Major without any merit and hired one of the top lawyers: it will be a story for a good book - otherwise it is a story for a good legal case."

With all our recent Lithium Drive into Electric space we should not forget about core values and how we are going to charge our High Voltage babies - Next Industrial Revolution means a lot of Copper from electric motors to smart power grids.

Xstrata's back in deadline is coming on 1st of October 2009. We have an estimation that they will back up - value proposition is too apparent. It will be a good thing in a sense of confirmation of Los Azules potential, but it could be a drag on project development with Xstrata's lack of focus and boardroom games. Small junior TNR Gold TNR.v, we are following, could hold some keys to project development and Robert McEwen's future role in its development.

Now we have some estimations on Los Azules value put forward by Robert McEwen in his presentation at Denver Gold Forum 2009.

1. Argentina - it is Nevada, but 100 years earlier.

2. Los Azules - one of the largest undeveloped Copper deposits in the world with 922 mln t of 0.55% Copper plus Gold and Silver.

3. 18% of the world copper resources concentrated in this area between Argentina and Chile - total 605 bln lb Copper.

4. Los Azules is bigger than 83% of the world copper deposits with good exploration potential.

5. Scoping study indicated high grade starter pit and NPV of 496 mln USD with Copper price at 1.9 USD/lb and 8% discount rate, NPV rises to 4 bln USD with Copper price at 3.0 USD/lb and 8 discount rate.

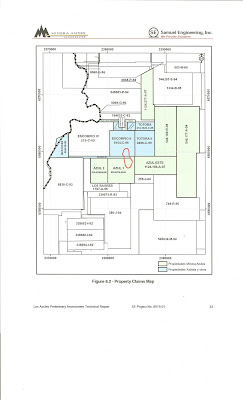

6. Copper target extension is 3 km in NW direction (towards Escorpio IV property of TNR Gold S.).

7. How much Los Azules worth?

Based on market valuation of Apoquinto, Corriente, Exeter and Norsemont with average valuation parameter of 0.037 USD per Copper lb resource Minera Andes 49% in Los Azules which is 5.5 bln lb of copper resource has "Implied valuation" of 203 mln USD.

This valuation will put Implied valuation of TNR Gold's back in right 12.5% (25% in half of the deposit) at 51.8 mln USD.

Rob McEwen has invested 60 mln in the company and owns 33%: "I am a big believer in the company where management owns a big part of the company: if I am making money - you are making money, I am making money only from capital gains."

We can see now that non executive chairman of TNR Gold Kirill Klip is not very original, but follows a good example - according to latest filing he owns 25% of TNR Gold, all management team and insiders are holding more than 50% of the company. After Xstrata's move TNR Gold with its 12.5% in Los Azules (subject to litigation outcome) could hold keys to Majority in Los Azules. Robert McEwen apparently is not very happy with his partners in San Jose mine to put it mildly, he is a driver and do not like to sit at the backseat. Maybe there will be room for a partnership between Minera Andes and TNR Gold with Xstrata holding non operational control in the end. Los Azules development is the matter of focus: for Xstrata it could be "another project" - with copper price above USD 3.0 per lb incentive could be more then enough for Rob McEwen to put another title next to Mr Gold Corp - Mr Andean Copper.

What can be better than listen to Mr Gold Corp Robert McEwen himself about Argentina and Los Azules:

Webcast Minera Andes Denver Gold Forum 2009

We will remind that nothing here should be taken as an investment advise - all valuations are only an invitation for further investigation and subject to data provided by third parties.

$5,000/oz gold? Rob McEwen says it's coming in 2014 or 2015

Über gold promoter Rob McEwen has also developed a taste for silver mining. Author: Dorothy KosichPosted: Tuesday , 15 Sep 2009

RENO, NV -

When über mining investor Rob McEwen makes predictions on gold prices or appears to have developed an interest in silver mines, retail investors heed his clarion call and place their bets that the gold price is about to soar.

In a presentation to the Denver Gold Group on U.S. Gold Monday, McEwen was somewhat subdued as he only briefly mentioned he thought gold could hit $5,000 an ounce before the end of the gold cycle As this reporter scrambled for a clarification of his remarks in a brief interview, McEwen stuck by his prognostication, forecasting the end of the gold cycle would occur either in 2014 or 2015.

McEwen is so dedicated to the power of gold, he told his audience of fund managers, analysts, investment bankers and miners that he personally owns 21% of U.S. Gold. In comparison most major mining CEOs own a mere pittance.

He is steadfast in his belief that the Cortez Trend-which hosts Barrick's massive Cortez Hills gold project-will yield millions of gold ounces for his U.S. Gold company.

But, McEwen also has developed a fondness for silver, albeit he lacks the same passion for the precious metal as he feels for gold.

He declared to his audience Monday that "El Gallo, Mexico is becoming one of the world's great silver discoveries. " With a 540,000-acre position in what he called "highly mineralized lands," McEwen's U.S. Gold is spending $10 million in exploration over 12 months. He anticipates an initial resource and heap leach test during the first quarter of 2010.

Though he told Mineweb his interest in silver has been stimulated more by individual mining properties rather than a newfound passion for silver, McEwen has also become active in Minera Andes, which he says owns 49% of the world's ninth largest silver mine, San Jose in Argentina. By 2010, McEwen forecasts that San Jose will have 7.5 million ounces of silver and 95,000 ounces of gold. He also predicts the operating cash costs will go lower than the 29% drop to $4.99/oz achieved in the first quarter of this year,

He also believes that Minera Andes' Los Azules project is "one of the largest undeveloped copper discoveries in the world. And in keeping with his philosophy as Minera's Chairman and CEO, McEwen owns 33% of the company's shares.

As the years roll by, McEwen's legendary penchant for marketing to the max remains intact as he offered audience members trillion dollar notes as an impromptu raffle prize at the conclusion of his talk."

No comments:

Post a Comment